Great Wall International Debit Card

Introduction

Great Wall International Debit Card is your ideal device for Point-Of-Sale (POS) purchase when you travel abroad, withdraw at ATM globally and purchase online; and a choice to pay with your own funds directly from your own bank accounts. It is a great alternative to carrying cash or cheque. You can enjoy the convenience and security of making purchases with your own money simply by linking your bank accounts to Great Wall International Debit Card. Great Wall International Debit Card is a combi card carrying both UnionPay International (UPI) and local Malaysia Debit Card namely, MyDebit of which payment accepted worldwide being largest payment network in Mainland China and Malaysia.

Great Wall International Debit Card supports another card brand, i.e. MasterCard which have similar functions such as Point-Of-Sale (POS) purchase, ATM withdrawal and online purchase. MasterCard payment is also accepted globally and being another choice for local and other countries’ usage.

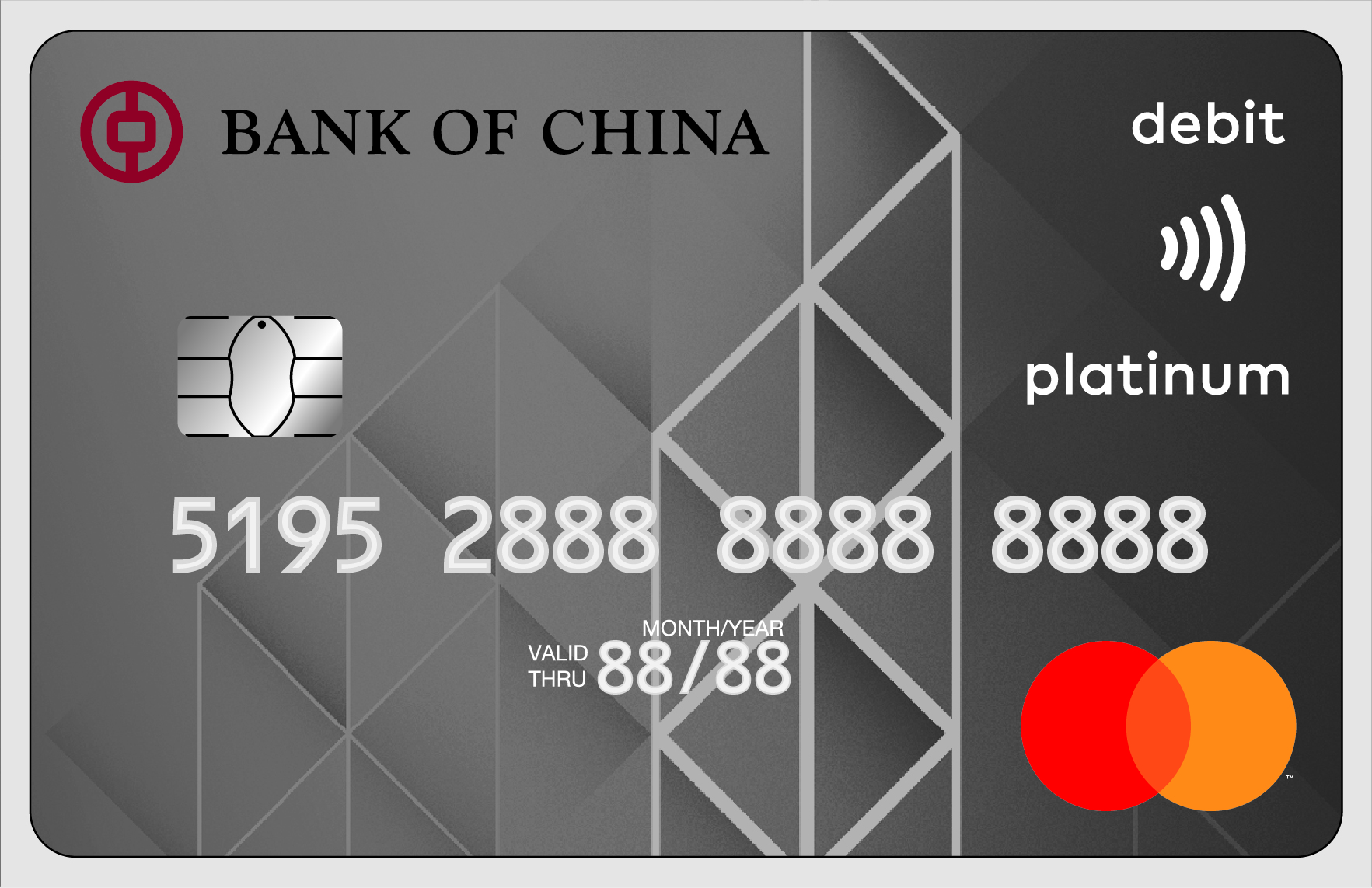

Card Design

| Type | Mastercard | UnionPay/MyDebit |

| Generic Card |  |

|

| Wealth Management Card |  |

|

Card Features

Note: (*) Not applicable to BOCM Student Debit Card

| Features | UnionPay & MyDebit | MasterCard |

|---|---|---|

| Currency | UnionPay – MYR/CNY MyDebit - MYR |

MYR |

| Feature |

|

Youth Card (Age 12-17 years old) : Only ATM Withdrawal function BOCM Student Debit Card: Only support ATM deposit and transaction take place through BOCM Point-Of-Sale (POS) Terminal within the selected school premises by invitation only.

|

| Overseas Transaction* | Overseas transaction is a transaction that is performed out of Malaysia. Overseas transaction includes Point-Of-Sale (POS) purchase, online purchase and cash withdrawal made at ATMs outside Malaysia. You are required to activate overseas use function prior to perform any retail purchase transaction or cash withdrawal at ATM outside Malaysia. | |

| Card-Not-Present Transaction (Internet Online Purchase)* |

Card-Not-Present (CNP) transaction is a card transaction made whereby the cardholder is not physically present at the merchant when the payment is made such as online purchase. You are required to activate Card-Not-Present function to enable non-3D secure transaction be transacted. | |

Overseas Transaction, Card-Not-Present Transaction and Contactless function can be activated or deactivated via branch's counter, contact our Customer Service Centre at 03-2059 5566 or self-service channels like BOCnet and Mobile Banking.

Controlled Your Spending

Stay in control of your finances. We give you the option to decide on your spending limit at Point-of-Sale (POS), withdrawal limit at ATM, contactless and cash out limit.

| Transaction Types | Card Type | Daily Transaction Limit | |

|---|---|---|---|

| Default Limit | Maximum Limit | ||

| Retail Purchase | Generic Card (Student- Note 2) | MYR5,000.00/ CNY10,000.00 |

MYR10,000.00/ CNY20,000.00 |

| Wealth Management Card | MYR50,000.00/ CNY100,000.00 |

||

| ATM Withdrawal | Apply All (Youth-Note 1) |

MYR5,000.00/ CNY10,000.00 |

MYR10,000.00/ CNY20,000.00 |

| Contactless (Single Transaction) |

Apply All (Student- Note 2) |

MYR250.00/ CNY500.00 |

MYR250.00/ CNY500.00 |

| MyDebit Cash Out (in Malaysia only) | Apply All Except Youth and Student Card | MYR500.00/ CNY1,000.00 |

MYR2,000.00/ CNY4,000.00 |

Note 1 : For Youth Debit Card, support ATM Cash withdrawal only and up to a maximum accumulative amount of MYR100.00 per day.

Note 2: For BOCM Student Debit Card , the contactless limit per transaction is up to MYR 100.00 and the default/maximum daily purchase limit (contact and contactless transaction) is MYR 1,000.00.

Cardholders can change their settings for daily retail purchase, ATM limit and cash out limit anytime via Mobile Banking App/BOCnet or visit any of Bank of China (Malaysia) Berhad branch or contact our Customer Service Centre at 03-2059 5566

Safety Tips

1. When your Debit Card being stolen, lost and/or being used for unauthorised transaction, Cardholder is advised to freeze account via Quick Lock in personal Mobile Banking App and report to the Bank immediately.

2. Cardholder is also advised to check all transaction alerts in a timely manner and to check account balances or statements of account on a regular basis.

3. Before travelling to any oversea country, Cardholder is advised to enable Oversea Transaction function and Card Not Present function to prevent any transaction being declined due to relevant function not enabled. Cardholder is also advised to deactivate such function if not in use after returning from oversea.

4. Debit Card eCommerce transaction existing authentication method SMS OTP will be discountinued after 23rd November 2025. Cardholder is encouraged to adopt new authentication method, Transaction Authentication via personal Mobile Banking App.

5. Cardholder who is non-mobile banking user is advised to subscribe personal Mobile Banking App to adopt new authentication method and continue online purchase after SMS OTP discontinued.

Exclusive Privileges

Cardholders can enjoy attractive and exclusive privileges with diverse merchants including dining, hotel, transportation, sightseeing, shopping and entertainment. For detail information, please find out more in Promotions.

Fees & Charges

Note: (*) Not applicable to Wealth Management Debit Card

| Type of Charges | Charge Amount (MYR) | ||

|---|---|---|---|

| Issuing/ Annual Fee* | 8.00 | ||

| Card Replacement Fee - Lost/Damage | Replacement due to faulty chip/ defective card/ enhancement made by the Bank | No Charge | |

|

12.00 Note: Replacement fee can be waived if customer provides a copy of police report lodged lost/ stolen card. |

||

| Sales Draft Retrieval (Only chargeable for original copy) | 20.00 | ||

| Balance Enquiry | No Charge | ||

| Cash Out Fee (Cash Withdrawal through selected MyDebit POS Merchants) | MYR0.50 per transaction | ||

| ATM Withdrawal Fees | |||

| Cash Withdrawal Fees at all Bank of China Malaysia ATM | No Charge | ||

| Cash Withdrawal Fees at other Local Banks ATM Note: Withdrawal fee waived for first two transactions for every calendar month |

MasterCard | UnionPay & MyDebit | |

| 4.00 | 8.00 | ||

| Cash Withdrawal Fees at Overseas Banks ATM | 12.00 | 15.00* | |

| *Not applicable to Wealth Management Debit Card for oversea ATM withdrawal via Bank of China's ATM in Mainland China | |||

| Foreign Currency Conversion Fee | MasterCard | UnionPay & MyDebit | |

| Within Malaysia (Transaction currency and settlement currency are same) |

No Charge | No Charge | |

| Mainland China | If customer holds CNY current account, transaction currency and settlement currency in CNY. | Not Applicable |

No Charge |

| If customer holds MYR account, transaction currency and settlement currency are different (CNY converts to MYR), transaction converted based on MasterCard/ UnionPay conversion rate plus conversion mark up. | 2% | 1% | |

| Other Countries/ Hong Kong, China/ Taiwan, China/ Macau, China (Transaction currency and settlement currency are different, transaction converted based on MasterCard/ UnionPay conversion rate plus conversion mark up. | 2% | 1% | |

For more BOCM Student Debit Card features, kindly click here.

Eligibility

- Bank of China (Malaysia) current or savings account holder aged 18 and above.

- Teenagers aged between 12 to 17 years old may apply for Youth Debit Card bearing MasterCard brand.

- BOCM Student Debit Card is offered to customer from selected schools by invitation only.

- Joint account is allowed subject to signing condition “Either One To Sign”.

- Document required is Identity Card (Resident) or Passport (Foreigner); supporting document such as valid working permit or student pass with at least 3 months validity is required for foreigner.