50 Years Together

Manage Your Wealth via Mobile Banking App Promotion

Campaign Period: 1st October 2024 – 31st December 2024

In celebration of the 50th anniversary of Malaysia-China diplomatic ties, we are bringing you an exclusive offer when you invest in Unit Trust or purchase insurance online with Bank of China Malaysia.

Category A: Online Unit Trusts Investment via <eWB> from Mobile Banking App

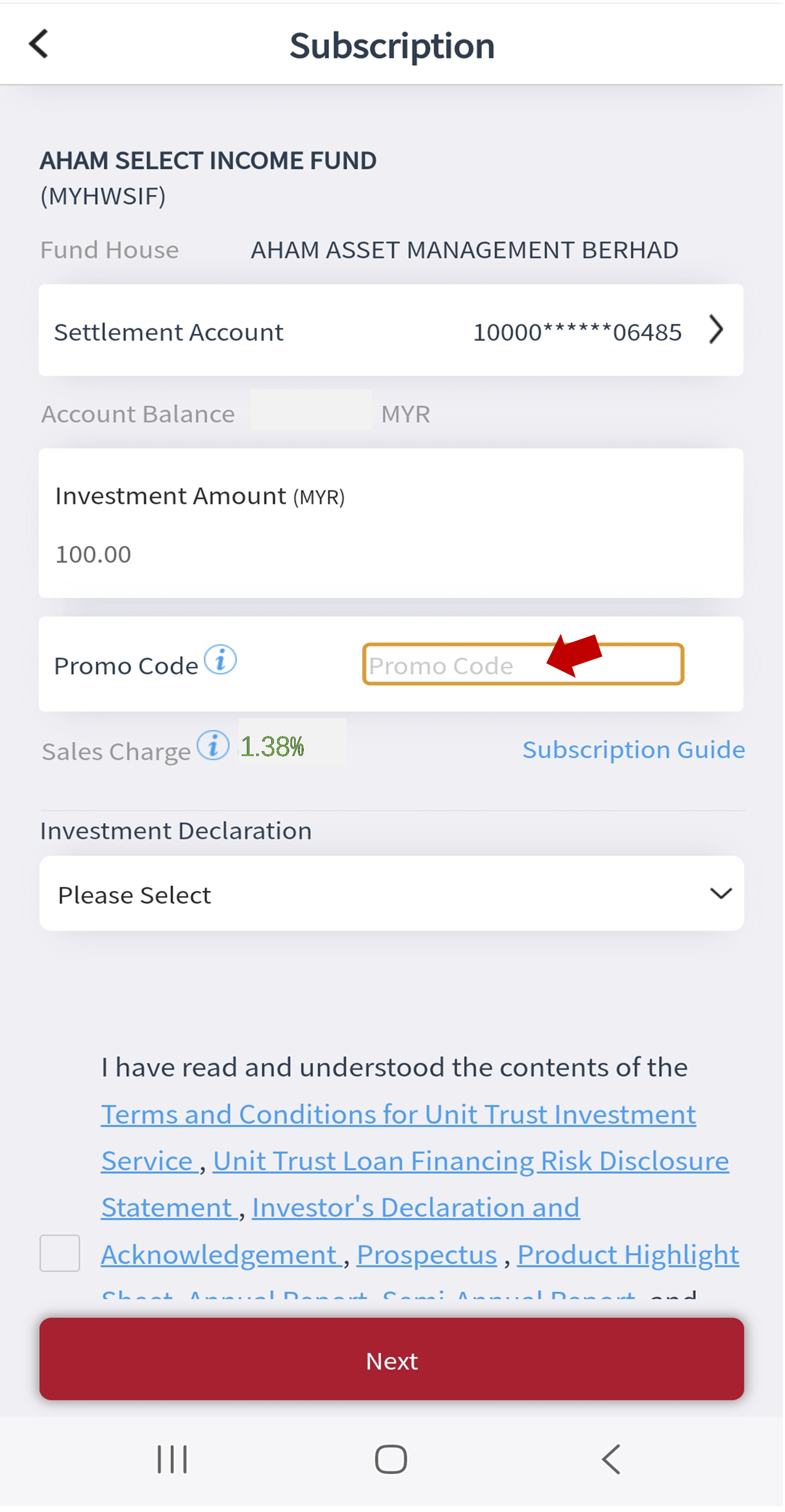

- To enjoy a 0.50% Online Sales Charge, key-in:

a) Promo code [50TGTMYR] for MYR Unit Trust investment; or

b) Promo code [50TGTCNY] for CNY Unit Trust investment.

- Applicable on MYR/CNY 10,000 investment amount per order. (to invest more than MYR/CNY 10,000, you can submit multiple order with the same promo code).

- The entire Promotion is capped at total 5 million denominated in MYR and 5 million denominated in CNY respectively.

How to participate:

- Log-in to Bank of China Mobile Banking App;

- Go to eWealth Banking module;

- Click “Unit Trust” => “Fund List” => filter by “MYR” or “CNY” => “Confirm”;

- Select MYR or CNY Unit Trust fund based on your Risk Profile and preference;

- Read and understand all “Related Documents” => “Subscribe” => key-in “Investment Amount” and details;

- Key-in promo code [50TGTMYR] or [50TGTCNY] before submit => Key-in eToken/Soft Token verification;

- Complete your investment and enjoy the promo sales charge.

Category B: Online Insurance Purchase via eINSURED

- Earn RM50 Cash Reward when you purchase insurance online:

- Eligible Insurance Plans:

a) MSIG Pet Insurance

b) MSIG Private Car Insurance (i.e. Comprehensive Private Car / Motor Plus / Lady Motor Plus);

c) MSIG TravelRight Plus Insurance (Annual Plan / Single Trip Plan with a minimum gross premium of RM300.)

NOTE: On top of RM50 Cash Reward, you can also enjoy premium instant rebate up to 25%. Refer to Terms and Conditions for “eINSURED Protect Ong-LINE Promotion” for details.

- Visit here to purchase online.

How to participate:

- Visit the eINSURED page on our website.

- Select your preferred insurance plan; read and understand the insurance product related documents;

- Complete the insurance purchase online, and you will receive a RM50 cash reward within 90-day upon successful purchase.

Terms and Conditions for “50 Years Together: Manage Your Wealth via Mobile Banking App Promotion” apply.

Unit Trust Products Disclaimer:

This content has not been reviewed by the Securities Commission Malaysia. Any decision in connection with any product must be made solely on the information contained in the respective prospectus, and no reliance is to be placed on any other representation.

Participants are advised to read and understand the contents of the prospectus before investing. Among others, Participants should consider the fees and charges involved. The price of units/bonds and distributions/coupons payable, if any, may fluctuate. Past performance is not indicative of future performance.

Participants should carefully assess if investment products are suitable for their risk appetite, based on explanations provided by the Bank’s sales staff (if any) and suitability assessments. The investment decision is solely the Participant’s responsibility. The relevant product offering documents should be read for further details.

Important Notes for Insurance Product:

The eligible insurance products are underwritten by MSIG Insurance (Malaysia) Bhd [Company No:197901002705 (46983-W)], a member of Perbadanan Insurans Deposit Malaysia (PIDM). Benefits under the eligible policy are protected by PIDM up to specified limits. Refer to the PIDM TIPS Brochure or visit www.pidm.gov.my for more information.

These products are distributed by Bank of China (Malaysia) Berhad [Company No: 200001008645 (511251-V)], a licensed bank under Bank Negara Malaysia. Assistance for product inquiries, claims, or complaints can be obtained through any Bank of China (Malaysia) branch.

INSURANCE DISCLAIMER

This document is not intended to be an invitation or offer for subscription of insurance nor does it amount to solicitation by BOCM or Participating Insurance Companies for subscription of insurance by anyone. Participants are advised to read and understand the contents of the Eligible Insurance Products brochure/policy contract at BOCM’s website before signing up.