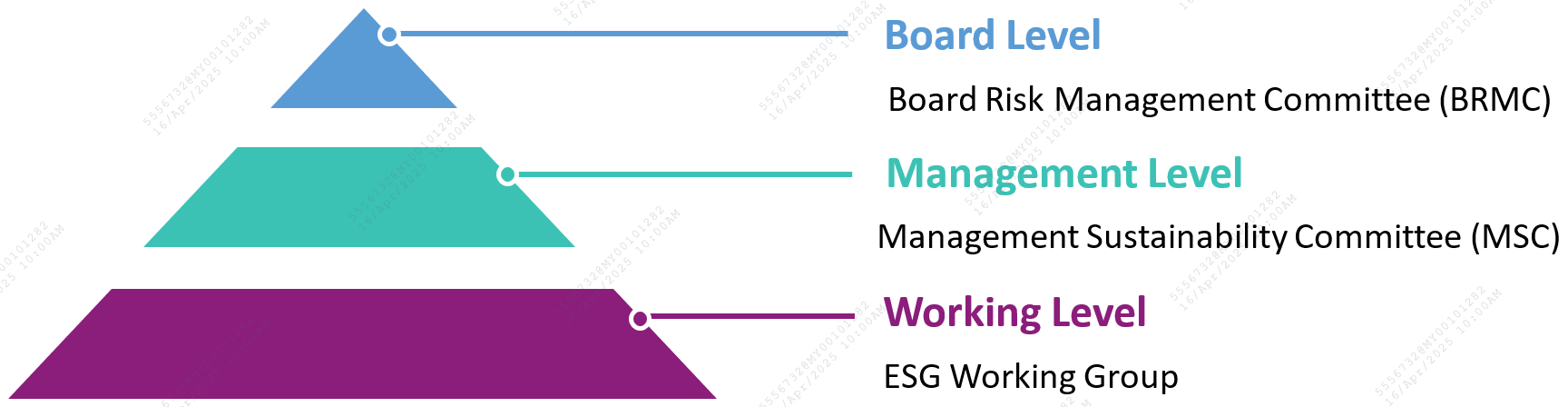

Governance and Policies for Sustainability

BOCM has established a management-level sustainability committee and a cross departmental working group to drive its sustainability agenda which includes Strategy, Products and Services, Banking Operations, Risk Management, Capacity Building and Disclosures.

Sustainability Governance Structure

The Management Sustainability Committee (MSC)

- Established in January 2022 to assist Senior Management in fulfilling oversight responsibilities with regards to sustainability matters and ensure that material sustainability factors are considered in all aspects of the Bank’s business operations.

Chaired by the Chief Executive Officer, with members comprised of the management team and heads of relevant departments.

The primary duties and responsibilities of the MSC are to:

Determine and review the Bank’s sustainability vision, objectives and strategy.

Establish sustainability framework, and ensure effective risk management and internal control systems.

Monitor the progress of the Bank’s sustainability-related initiatives against measurable outcomes and target timeline.

Ensure that sustainability reporting and disclosures comply with the regulatory requirements.

The ESG Working Group

A cross departmental working group with members from relevant departments.

The working group facilitates the coordination and execution of the Bank’s sustainability-related initiatives to ensure effective implementation.

It also serves as a forum for members from different departments to deliberate issues arising from the Bank’s sustainability-related projects.

Sustainability-related Policies

BOCM has a range of policies that guide its approach to conducting business in a sustainable manner.

1. ESG Sensitive Sector Strategy Statement

The "ESG Sensitive Sector Strategy Statement" outlines the mid-term strategies towards ESG sensitive sectors during the provision of financial services, with an aim to support the Bank’s long-term sustainability plan.

The purpose of the Statement is to foster the implementation of sustainability strategies and targets, enhance the resilience of its portfolio to climate change, and demonstrate the Bank's commitment to sustainability in the ordinary course of business while balancing the needs for economic development and impacts on climate, environment and society.

2. Sustainability Policy

The "Sustainability Policy" outlines the key principles and scope, stakeholder communication, management structure and responsibilities in promoting sustainable development in BOCM’s business operations with relations to the environment and society.

The intent of this Policy is to ensure that the Bank operates in a sustainable and responsible manner through balancing its stakeholders’ interests and impact on the environment, society and economy, in order to achieve long-term sustainability for both the Bank and its stakeholders.

3. Climate-related Disclosures Policy

The "Climate-related Disclosures Policy" is to specify BOCM's objective to promote credible as well as high-quality disclosures and mitigate the risk of greenwashing. This policy outlines the internal controls, including verification and review to ensure accuracy and completeness, and the governance over the climate-related disclosures process.

4. Credit Risk Management related to Climate, Environmental and Social Risks Procedure

The "Credit Risk Management related to Climate, Environmental and Social Risks Procedure" outlines the key principles and scope, management requirements, management structure and responsibilities in promoting an effective credit risk management towards sustainable finance and business development.

5. Guideline for Climate Transition Risk Analysis

The "Guideline for Climate Transition Risk Analysis" is to facilitate the implementation of the sustainability development strategy and comply with the general principle and sector requirements stipulated in BOCM’s “ESG Sensitive Sector Strategy Statement”. This guideline aims to formalise the climate transition risk analytic and management requirements for brown industry customers.